It’s that time again – a brand new tax year is upon us! Keeping on top of finances is crucial for your childcare business and this year brings some key changes to be aware of:

Funded Hours Expansion:

Offering funded hours for the first time, or seeing an increase in funded children? Ensure you and parents maximise this benefit. Check the latest guidelines on GOV.UK’s “Information for Childcare Providers” and the Childcare Choices website for proper procedures. Contact your local authority for specific details and set reminders for application renewal each term to avoid delays.

Minimum Wage Increase:

Employing assistants? Be aware of the new National Minimum Wage and National Living Wage rates. Factor this increase into your costs to maintain profitability.

National Insurance Updates:

For the self-employed: The main rate of Class 4 National Insurance (NI) has been reduced. Class 2 NI is no longer due. If you employ staff: Class 1 NI contributions have also decreased. Understand these adjustments and their impact on your tax bill.

Child Benefit Changes:

Child benefit rates have increased, along with the eligibility threshold. Consider how this will affect the families you care for, and your own household income if applicable.

Staying Financially Organised:

Running a successful childcare business requires strong financial management. Here are some resources to help you stay on top of your finances:

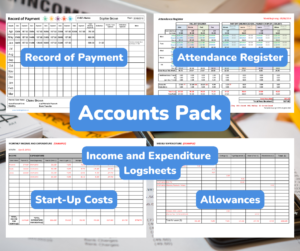

Accounts Pack

This pack provides simple logsheets to track your weekly, monthly, quarterly, and annual income and expenses, along with a helpful guide to keep your accounts organised.

Invoices, Receipts & Letterheads

Ensure a professional touch with downloadable templates for creating invoices, receipts, and letterheads.

Childcare Contracts Pack

Protect yourself and your clients with professional childcare contracts for all types of childcare arrangements including term time, temporary and funded hours.

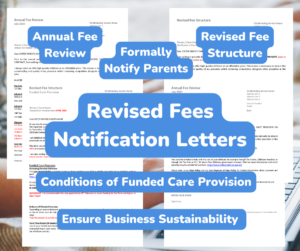

Revised Fees Notification Letters

Formally notify families of any changes to your fees structure in a professional manner.

Exciting App Updates Coming Soon!

We’re excited to announce that our new app, packed with features to streamline your business management, is nearly here! Our app users will soon be able to:

- Effortlessly Track Finances: Record income and expenses directly within the app, taking the hassle out of bookkeeping.

- Save Time on Invoicing: Send professional invoices and payment reminders to parents with just a few clicks.

Stay tuned for more information on these exciting app updates and MORE!

Remember, a well-organised financial system is key to a thriving childminding business. Download our resources today and get ready to make the most of the new tax year!