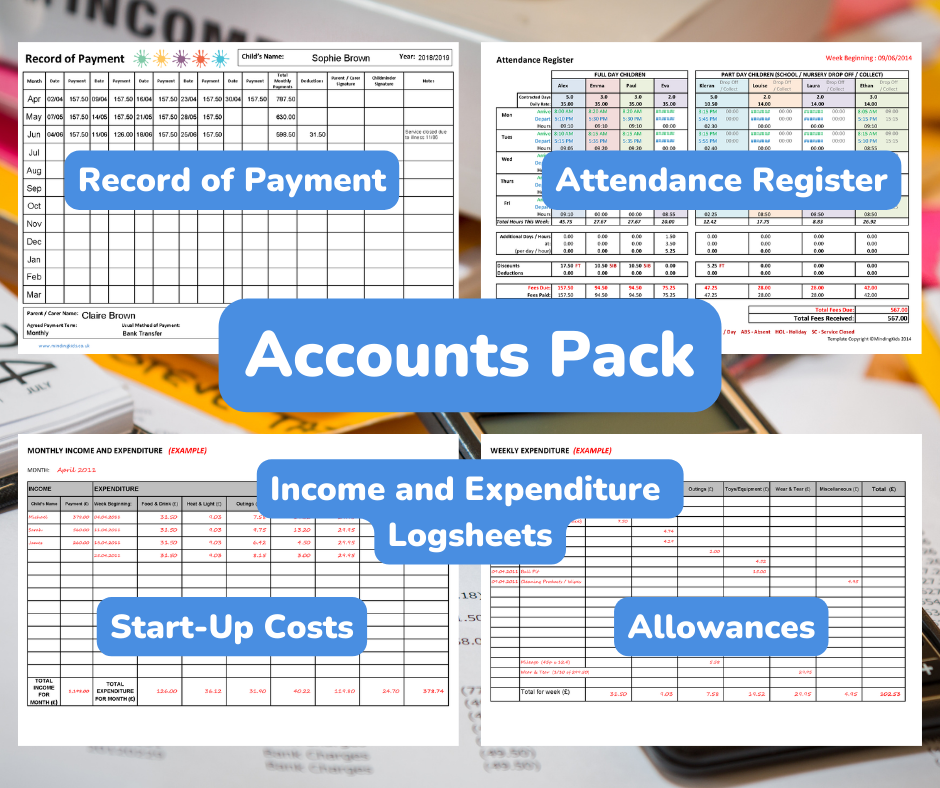

Accounts Pack

Easily work out your weekly, monthly, quarterly and annual income and expenses using simple logsheets. Includes a handy guide to help you get your accounts in order. Plus use the Excel Attendance Register to automatically calculate hours attended and what fees are due!

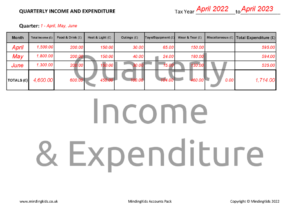

Includes Quarterly Income and Expenditure Log Sheets in preparation for Making Tax Digital (MTD).

Making Tax Digital (MTD)

NOTE: Roll out of the government’s Making Tax Digital (MTD) programme has been delayed for self-employed individuals

From 6th April 2026, Making Tax Digital (MTD) will be mandatory for all self-employed people in the UK with an annual income of more than £50,000 from self-employment. From April 2027 MTD will be required for those earning between £30,000 and £50,000. MTD compatible software will be required to keep digital records with tax returns filed at least quarterly (3 monthly). HMRC guidance Using Making Tax Digital for Income Tax explains how to meet the requirements and find suitable software.

The majority of software packages will allow users to upload invoices, receipts or spreadsheets in order to make the relevant tax calculations. Minding Kids is keeping a close eye on the requirements for MTD and will make changes to this pack, if required, to best support our customers. In the meantime, getting into the habit of completing your accounts records quarterly will help you prepare for the change.

Easily work out your weekly, monthly, quarterly and annual income and expenses using simple logsheets.

This comprehensive accounts pack contains all the logsheets you require along with a handy guide to help get your accounts in order.

Supplied as both Excel worksheets and PDF forms, you can choose to complete on your computer or tablet, or print out and fill in by hand.

This pack contains all of the following:

- Accounts Pack User Guide – informative guide with all you need to know about allowable expenses and how to record and calculate your business accounts

- Attractive Front Cover

- Record of Payment forms – Note down payments received for each child including the dates they were made, any deductions and the reasons for these and request parents to sign to avoid any disputes. Example Included.

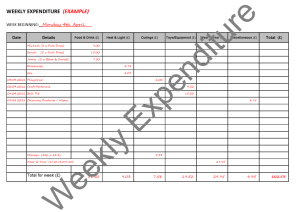

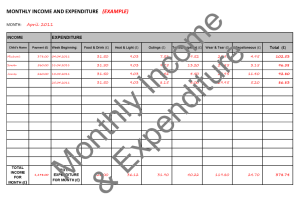

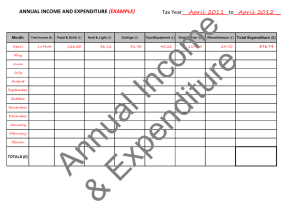

- Logsheets to record; Weekly, Monthly, Quarterly and Annual Income and Expenditure plus examples

- Annual Summary of Income and Expenditure Sheet

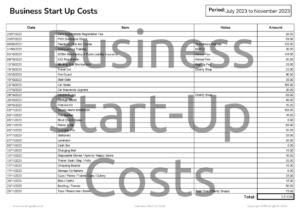

- Business Start-Up Costs plus example logsheet

Plus…

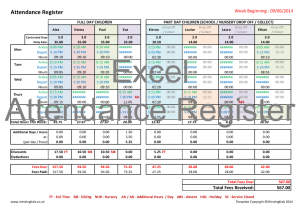

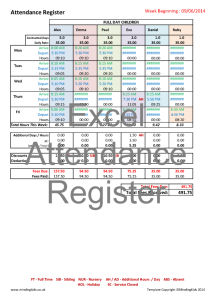

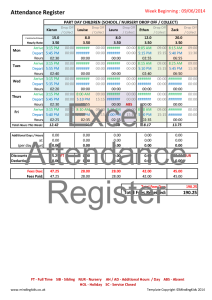

Excel Attendance Register

Simply enter attendance information for each child and these sheets will automatically calculate the hours attended for each child and what fees are due.

Choose from a variety of styles depending on whether you charge a daily fee or an hourly rate and whether you care for children who attend for full days or only for part (or parts) of the day. For example, school children who attend your setting for an hour before school, then again for a couple of hours later in the afternoon. If you care for a mix of both full day and part day children there is also a register which accommodates this.

As well as all of the above, you can also add in additional hours, discounts and deductions making calculations a doddle!

User instructions and completed examples are included.

👀Not familiar with Excel? Find a PDF Attendance Register included in the Logbooks & Forms Pack OR use the MindingKids App to record attendance.

Please see the Further Details tab above for file format and supply information.

👉Visit our Setting Management section for more resources to help you to manage and organise your professional childcare service.

or…become a MindingKids member for UNLIMITED ACCESS to ALL our OUTSTANDING Resources!

Reviews

You must log in and be a buyer of this download to submit a review.

All Logsheets are supplied as both Excel worksheets and PDF Forms and will automatically calculate any digitally entered information. Simply save to your computer then click in each area to enter information. Your weekly, monthly, quarterly and annual income and expenditure will be automatically calculated for you! Simply ‘save as’ and create a fresh logsheet to record income/expenditure for a new week, month or year.

The Record of Payment forms and Business Start-Up Cost Sheet are supplied as PDF forms. Use the ‘Complete and Calculate’ versions and the sheets will automatically calculate the totals.

If you prefer to print out and fill in by hand, simply print out the worksheets to complete.

The front cover and annual summary are supplied as a PDF Forms, simply click in each area to enter information.

The Excel Attendance Register sheets are supplied as Excel worksheets.

The guide, user instructions and example start-up cost sheets are PDF files which are non-editable.

The download version of this pack is supplied as a ZIP FILE. Please see the Help page for further information.

This item has been carefully designed to assist childcare providers in completing their accounts and the information required for their annual self-assessment as required by HM Revenue & Customs.