The clock is ticking! The deadline for completing your HMRC Self Assessment Tax Return is looming.

Have you submitted yours?

If you have already completed yours well done for being organised but remember that you must pay any tax due by midnight on 31st January to avoid a penalty.

Feeling a bit lost when it comes to working out income and expenses?

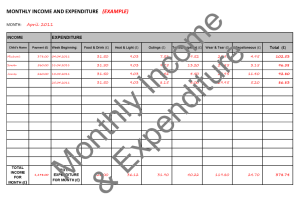

Our Managing Your Accounts HOT Topic covers the basics of what you need to do…

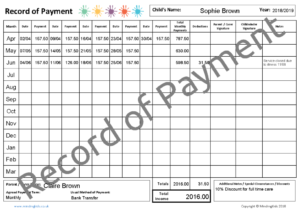

and our Accounts Pack includes all the logsheets you require along with an informative guide to help you keep accurate records of your business finances.

Coronavirus Impact

Sadly many childcare businesses have been impacted by the coronavirus and we will all feel the effects of the pandemic for some time to come.

If you have experienced a loss of income due to the pandemic, for example as a result of enforced closure, lost contracts as parents themselves have lost jobs, or where your services are no longer required whilst parents work from home, then you may be able to claim a grant or claim other financial support.

Guidance for people who are self-employed and getting less work or no work because of coronavirus (COVID-19) can be found on the Government website.

You may be able to claim a grant via the Self-Employment Income Support Scheme, or if you are not eligible, there is further information about other help you can get.

The Money Saving Expert website also has some very useful information and Coronavirus Guides to help us manage our finances through this uncertain period.

Struggling to submit your return or pay your tax bill on time?

If your reason for late submission of your return due to coronavirus-related reasons, HMRC have confirmed that it “will accept” pandemic related personal or business disruption as a “reasonable excuse” and will cancel penalties, provided you file as soon as possible. Find further information on the MSE website here.

If, due to coronavirus you are in a position where you cannot afford to pay your tax bill, HMRC has a dedicated helpline that you can call for advice. You may have the option to set up a payment plan which will allow you to spread the cost of your bill. Find further information about what options are available to you here.

Further financial support

If your families income has reduced, it may also be worth checking whether there is any other financial support available. This benefits calculator will help you to check whether you are eligible and the citizens advice website has information regarding further support available due to the pandemic.