Making Tax Digital (MTD)

NOTE: Roll out of the government’s Making Tax Digital (MTD) programme has been delayed for self-employed individuals

From 6th April 2026, Making Tax Digital (MTD) will be mandatory for all self-employed people in the UK with an annual income of more than £50,000 from self-employment. From April 2027 MTD will be required for those earning between £30,000 and £50,000. MTD compatible software will be required to keep digital records with tax returns filed at least quarterly (3 monthly). HMRC guidance Using Making Tax Digital for Income Tax explains how to meet the requirements and find suitable software.

The majority of software packages will allow users to upload invoices, receipts or spreadsheets in order to make the relevant tax calculations. Minding Kids is keeping a close eye on the requirements for MTD and will do our to best support our customers via our Accounts pack and App.

Managing your Accounts

Take the stress away by following our helpful tips…

1. Don’t panic!

Have a read through HMRC Self-Employment guidance online to help you to understand what needs to be done, when and why.

Remember that you need to notify HMRC as soon as you start your self-employment. You can do this here.

2. Find an organised method to record your income and expenditure.

HMRC will need to know the total income you receive each tax year (6th April to 5th April the following year) and what you have spent (total expenses) as a result of running your business.

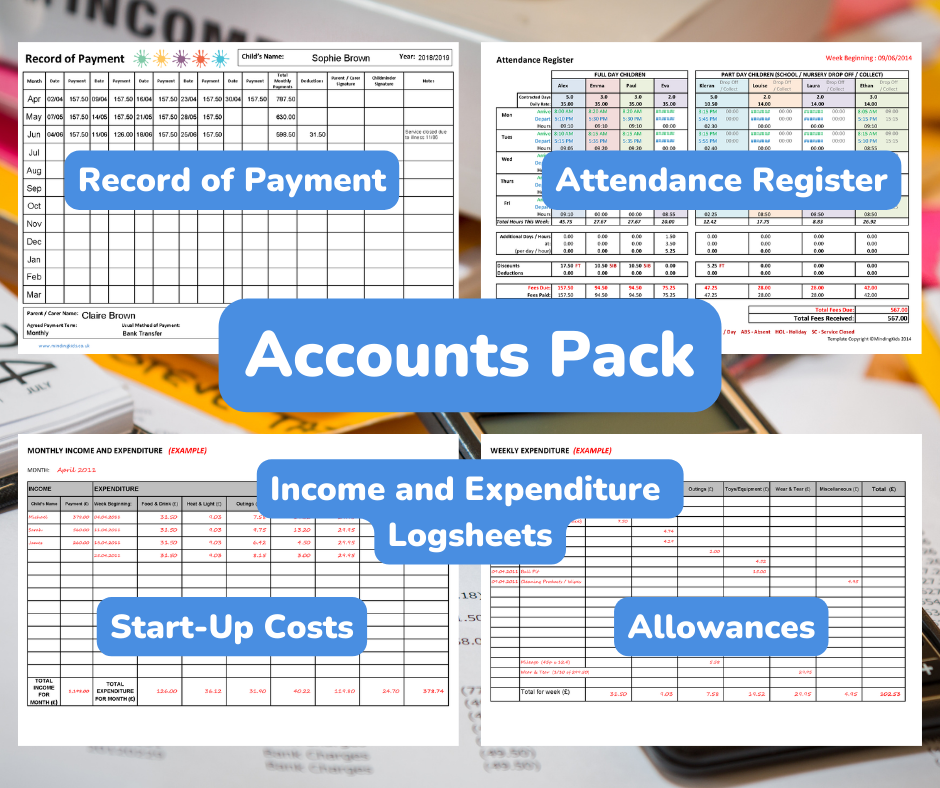

Refer to our Accounts Pack for all the logsheets you will require to keep accurate records of your business finances. These can be completed, calculated and saved digitally or printed out and filled in by hand.

Whatever methods you use to record income and expenditure, remember that your income is the amount that you actually receive. Do not include any outstanding fees until they are actually paid. If you are unsure about what you can include as allowable expenses, refer to HMRC guidance.

You can also find HMRC’s guidance for childminders here.

3. Remember to keep receipts and write EVERYTHING down!

Whilst HMRC ask only for receipts for items costing £10 or more, keeping all receipts which include even small items or taking notes in a notebook or on your phone will help you to ensure that you don’t forget anything when calculating your business expenses. Small everyday costs such as playgroup fees, purchasing ice lollies at the park or picking up some wipes at the shops can really add up over the year so don’t forget these small outlays as they could add up to make a BIG difference to your tax bill at the end of the year.

As soon as you receive a payment, you should take a note of the date and amount and, if possible, issue parents with a receipt or ask them to sign a payment record form. This will allow you to keep an accurate record of what has actually been paid and also help to avoid any disputes.

4. Ensure your fees and payment policies are clear.

To avoid disputes with parents and ensure that you are paid in full and on time, make sure that you are clear about the fees that you charge, when payments are due and the methods in which payments can be made at the very beginning of any childcare arrangement. Having a Fees Policy and a Late Payment of Fees Policy in place will allow you to explain everything parents need to know about paying for your service and what charges are made for holidays, illness, additional hours, etc.

Refer to our Policies & Procedures Pack for templates.

Issuing invoices to parents will remind them that it is time to make payment and also set out clearly any reductions or additional charges. Refer to our Invoices, Receipts & Letterheads templates.

If you are unfortunate enough to have late or non-paying parents make sure that you follow your late payment procedures and take note of each time you request or remind parents and also whether any payment plans are agreed.

This step is more to do with your own business management than what is required by HMRC but it is important. If a parent is continually late with payments, this could risk putting you, your business and your own family into financial difficulty.

5. Keep on top of your records

You may be brilliant at recording when fees are paid and keeping receipts but unless you set aside time on a regular basis to update your financial records then you risk spending hours calculating everything in one go in order to submit your HMRC self-assessment on time.

If possible, try to set aside half an hour each week or an hour or so each month to update your income and expenditure records. You may find it useful to do this at the same time as when you are calculating invoices for parents or when you receive your monthly bank statement so that you can see clearly your income and outgoings. If you stay on track then you will only need to add together your monthly totals at the end of the financial year rather than spending hours with your calculator!

6. Set aside money each month or make regular tax payments

Remember that when you are self-employed any tax that you are due is not automatically deducted from your income. You will need to set aside money or set up regular payments in order to cover your tax bill…unless you expect that your annual income will fall below the tax-free personal allowance (currently £12,570 for tax year 2022/23). You may find that this is the case in your first year as a childminder or if you have several vacancies, or if some of your spaces are being filled by your own children. Remember that despite your income falling below the threshold, you are still required to complete a self-assessment and may also need to maintain your National Insurance contributions in order to be entitled to certain benefits.

A good guide is to put aside 20% of your income each month, if you can afford this.

7. Complete your return and pay your tax bill on time!

If you have registered with HMRC online services then you can complete and submit your self-assessment online. If you have not already registered, do not leave it until the last minute as you will require an Activation Code in order to log in which can take up to 7 days to arrive.

You do not have to complete the form all at once, you can save and return to it and if you get stuck, you can find further guidance on the HMRC website here.

Remember to submit your return on time (by midnight on 31st January each year) and pay your bill to avoid being charged a penalty.